Equipment Financing Terms Explained: What You Need to Know Before Signing

Explore equipment financing terms explained in plain language. Understand rates, repayment, and agreements before you sign any contract.

How to Prepare Your Business for a Revenue-Based Financing Application

Discover how to prepare for a revenue-based financing application. Follow simple steps to improve approval odds and secure growth capital.

The Future of Business Financing: Why Flexibility and Speed are the New Standard

Flexibility and speed define the future of funding. See how small business loans based on revenue help businesses grow smarter.

5 Common Mistakes Small Businesses Make When Seeking Funding (And How to Avoid Them)

Discover the 5 most common mistakes entrepreneurs make when seeking small business loans—and how you can avoid them with smarter funding.

Same Day Business Funding: Fast Capital Solutions to Keep Your Growth on Track

Explore how same day business funding delivers quick capital solutions to fuel growth, boost cash flow, and keep your business moving forward.

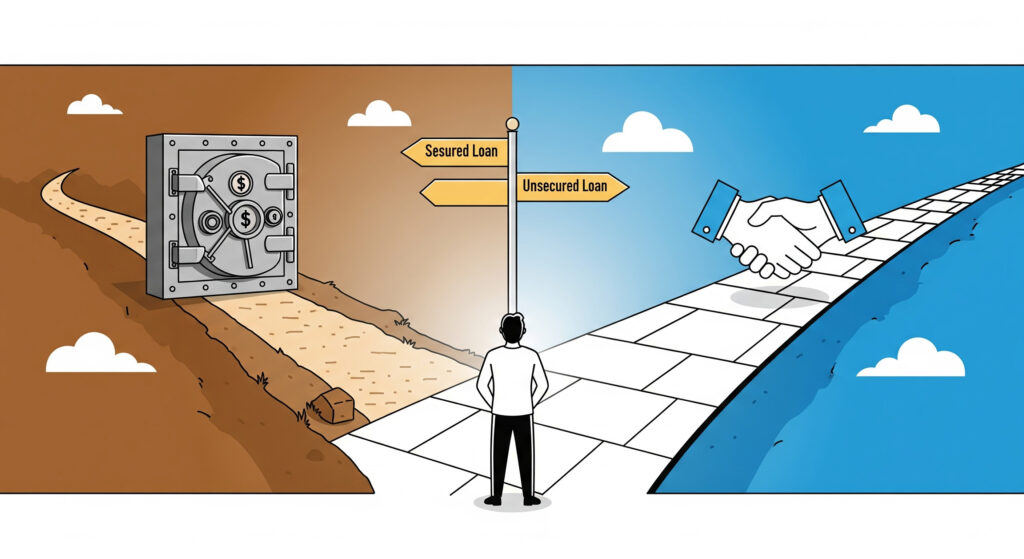

Is Your Business Loan Secured or Unsecured? A Simple Guide to the Difference

Understand secured vs unsecured business loans in this simple guide. Learn benefits, risks, and how to pick the right funding for your business.

Powering Up Your Fitness Center: A Guide to Financing Gym Equipment

Learn the best ways of financing gym equipment for your fitness center. Explore loans, brokers, and funding tools to grow with confidence.

Equipment Financing Requirements: Everything You Need to Qualify

Explore equipment financing requirements and discover what you need to qualify. From credit to documents, get the tools to secure funding faster.

Merchant Cash Advances: Are They Legal for Small Businesses?

Discover whether merchant cash advances are legal for small businesses. Get clarity on rules, lenders, and smarter funding alternatives today.