Why “Direct Lender” Isn’t Just a Buzzword

When you’re looking for fast business funding, you’ve probably seen the phrase “merchant cash advance direct lenders” appear all over the internet. It sounds good, right? A direct lender suggests speed, simplicity, and control — but what does it actually mean? And more importantly, how does it affect your bottom line?

Knowing whether you’re dealing with a legitimate lender or a broker who is merely serving as an intermediary is essential for small businesses managing expenses, payroll, or inventory costs. You can save time, money, and frustration by being aware of the differences. Plus, it can help you find the best revenue based financing option for your business goals.

Let’s explore what “direct lender” truly means, how MCA lenders operate, and why choosing wisely can help you access reliable funding faster.

What Is a Direct Lender?

A direct lender is just that—a business that gives money to your company directly, without going through a middleman. This implies that they have complete control over the approval, financing, and repayment processes.

In contrast, brokers act as middlemen. They connect you with different funding providers, taking a commission for their services. While that might seem harmless, it can complicate communication, slow down funding, and sometimes increase your costs.

When you deal directly with the source — such as merchant cash advance direct lenders — you gain transparency. You know who’s evaluating your application, where your money is coming from, and who you’ll repay.

Why Direct Lending Matters for Small Businesses

For many small business owners, speed is everything. Whether it’s covering emergency repairs or paying seasonal staff, cash flow gaps don’t wait. That’s why working with a direct lender can make a huge difference.

Instead of waiting days for a broker to find a match, a direct lender reviews your application and makes decisions in-house. This streamlined process means funds often reach your account within 24–48 hours.

Additionally, direct lenders offer better communication. You can ask questions, get accurate updates, and negotiate repayment structures directly. No more middlemen, no more back-and-forth emails.

If you’re looking for flexible options that keep up with rising costs, check out this helpful guide: Stop Inflation from Killing Your Budget: Get Flexible Funding.

Understanding Merchant Cash Advances (MCAs)

Before diving deeper, let’s quickly review what a merchant cash advance actually is.

An MCA isn’t technically a loan. Instead, it’s a purchase of your future receivables. The lender advances a lump sum of cash, and you repay through a percentage of your daily or weekly sales.

This model is perfect for businesses with fluctuating income, like restaurants or retail stores. When sales are strong, payments are higher; when business slows, payments drop automatically. That’s what makes MCAs so appealing for entrepreneurs seeking adaptable financing.

Because MCA lenders evaluate revenue rather than credit scores, they’re often faster and more accessible than traditional banks. To calculate your estimated repayment amount, you can use an MCA calculator — a simple online tool that helps visualize potential costs and terms.

The Direct Lender Advantage in MCA Funding

Now that you understand what MCAs are, let’s look at how direct lenders change the game.

When you go through a broker, they send your application to multiple MCA lenders. Each one might pull your credit, evaluate your business, or even contact you directly. That means more calls, more confusion, and often, inconsistent offers.

Conversely, a direct lender does it all centrally. They review your cash flow, approve advances and issue funds in your direction directly. It streamlines the funding process and keeps your data secure.

Another major benefit? Lower overall costs. Since brokers add commissions, direct lenders often offer more competitive rates and faster processing. That can be a major advantage when time and money are tight.

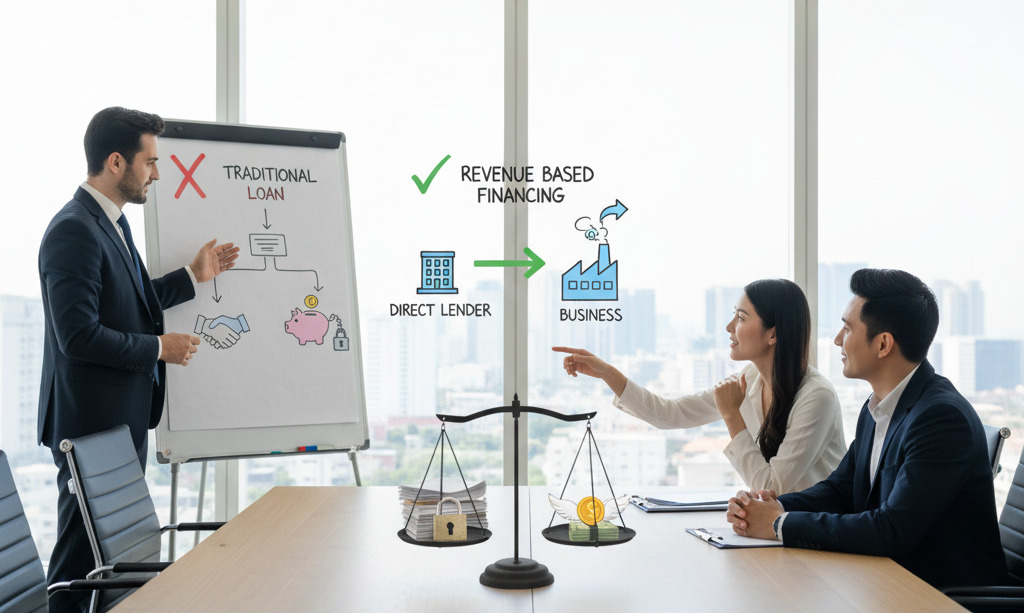

Revenue Based Financing vs. Traditional Loans

All financing is not equal. Conventional bank loans tend to be associated with rigid terms — long applications, collateral requirements, and unforgiving repayment conditions.

Revenue based financing, however, varies your repayment based on your business performance. It’s a convenient solution for businesses with variable cash flow or seasonal income.

Here’s an easy comparison table to make it clear for you to understand:

Feature | Traditional Business Loan | Revenue Based Financing |

Credit Check | Required | Not always required |

Collateral | Often needed | Usually not required |

Repayment | Fixed monthly payments | Variable payments based on sales |

Speed | Slow (weeks) | Fast (1–3 days) |

Ideal For | Established businesses | Small or growing businesses |

If your company deals with unpredictable sales cycles, you might find revenue based financing a much better fit. To learn if your business qualifies, check this full list of industries in Is My Industry Eligible? A Full List of Businesses Approved for Revenue Based Funding.

How Direct MCA Lenders Evaluate Your Business

You might wonder how direct MCA lenders decide whether to fund your business if they’re not relying on credit scores. The answer lies in your daily revenue and transaction patterns.

Most MCA lenders look at your business’s bank statements or credit card sales over the past three to six months. They want to see consistent deposits and healthy cash flow. Unlike banks that prioritize credit history, direct lenders prioritize current performance.

This approach makes merchant cash advances ideal for startups and small businesses that haven’t yet built strong credit. The evaluation process is quicker, often requiring minimal documentation — which means funds can hit your account within days.

Common Misunderstandings About Direct Lenders

One common misconception is that all lenders calling themselves “direct” truly are. Unfortunately, some brokers advertise as direct lenders to attract more applicants, only to outsource funding later.

That’s why it’s essential to verify the company’s credentials before applying. Check if they fund advances under their own business name. Real merchant cash advance direct lenders will be transparent about where the funds come from and how repayment works.

To protect yourself, always read the fine print. Ask if the lender services your advance directly or if they pass it along to another company. Transparency builds trust — and trust leads to better financial relationships.

When to Choose a Direct MCA Lender

So, when is a direct MCA lender your best option?

If you need fast funding for equipment repairs, inventory restocking, or to handle a short-term cash flow gap, going straight to the source is often the smartest move. You’ll save time, avoid broker fees, and get personal support from people who understand your business model.

For example, if you’re a contractor experiencing sudden equipment problems, you can explore this guide on The Contractor’s Edge: Fast Revenue-Based Funding for Unexpected Equipment Repairs.This is a great resource to understand how direct funding options can help your business run smoothly.

Questions to Ask Before You Apply

Before submitting your application to any lender, ask these key questions:

Question | Why It Matters |

Are you a direct lender or a broker? | Ensures transparency and saves you from extra costs. |

How fast can I receive funds? | Helps you plan for urgent needs. |

What are your fees and repayment terms? | Prevents hidden charges. |

Do you use a factor rate or interest rate? | Factor rates can make repayment more predictable. |

Can I use an MCA calculator before signing? | Helps you estimate repayment and cash flow impact. |

Asking these questions upfront ensures you’re making an informed decision that aligns with your goals.

How to Use an MCA Calculator Wisely

A mca calculator is one of the best tools a business owner can use before accepting an advance. It helps you understand how much you’ll repay, how long it’ll take, and how it might affect your daily operations.

To use it effectively, input your advance amount, factor rate, and expected daily sales. The calculator will show your estimated repayment total and term length. It’s a simple way to visualize your cash flow and prevent surprises later.

Remember, a smart borrower is an informed one. Always calculate before you commit.

Balancing Speed with Strategy

Speed is important, but it shouldn’t come at the expense of strategy. While merchant cash advance direct lenders offer convenience, it is essential to choose partners that are in line with your financial goals.

If you’re planning for long-term sustainability, use direct MCA funding as a bridge – not a permanent solution. Combine short-term advances with long-term financing strategies such as revenue-based financing to maintain healthy growth and stability.

By balancing the two, you can enjoy the best of both worlds: immediate access to cash and smart financial planning for the future.

The Bottom Line

Choosing the right funding partner can make or break the growth of your business. Direct lenders provide clarity, stability, and confidence – three things every small business owner needs.

While brokers can play a role in connecting you with different options, going straight to a merchant cash advance direct lender puts you in control. You know who you’re dealing with, how the funds are distributed, and exactly what you’ll be paying.

With the right funding partner and smart use of tools like MCA calculator, you can manage cash flow efficiently, avoid surprises and grow your business with confidence.

FAQs

Q1: What’s the main difference between direct lenders and brokers?

Direct lenders provide the funds themselves, while brokers simply connect you to lenders and earn commissions.

Q2: Are merchant cash advance direct lenders safe?

Yes — as long as they’re transparent about their funding process and repayment terms. Always verify credentials before applying.

Q3: How do MCA lenders decide approval?

They review your daily sales, bank statements, and business performance instead of credit scores.

Q4: Can I use a revenue based financing option instead of an MCA?

Absolutely! Both are flexible, but revenue based financing can be better for businesses wanting less frequent repayments.

Q5: How do I estimate repayments?

You can use an mca calculator to predict total repayment amounts and plan your cash flow more effectively.

Final Takeaway

Choosing a merchant cash advance direct lender isn’t just about getting money fast — it’s about choosing clarity, control, and smarter business growth.

When you work directly with your lender, you’re not just borrowing – you’re building a partnership. And it’s exactly that kind of relationship that helps businesses thrive even in unpredictable times.